New YEAR sale closing in

Your search for consistent profitability from trading ends here ….

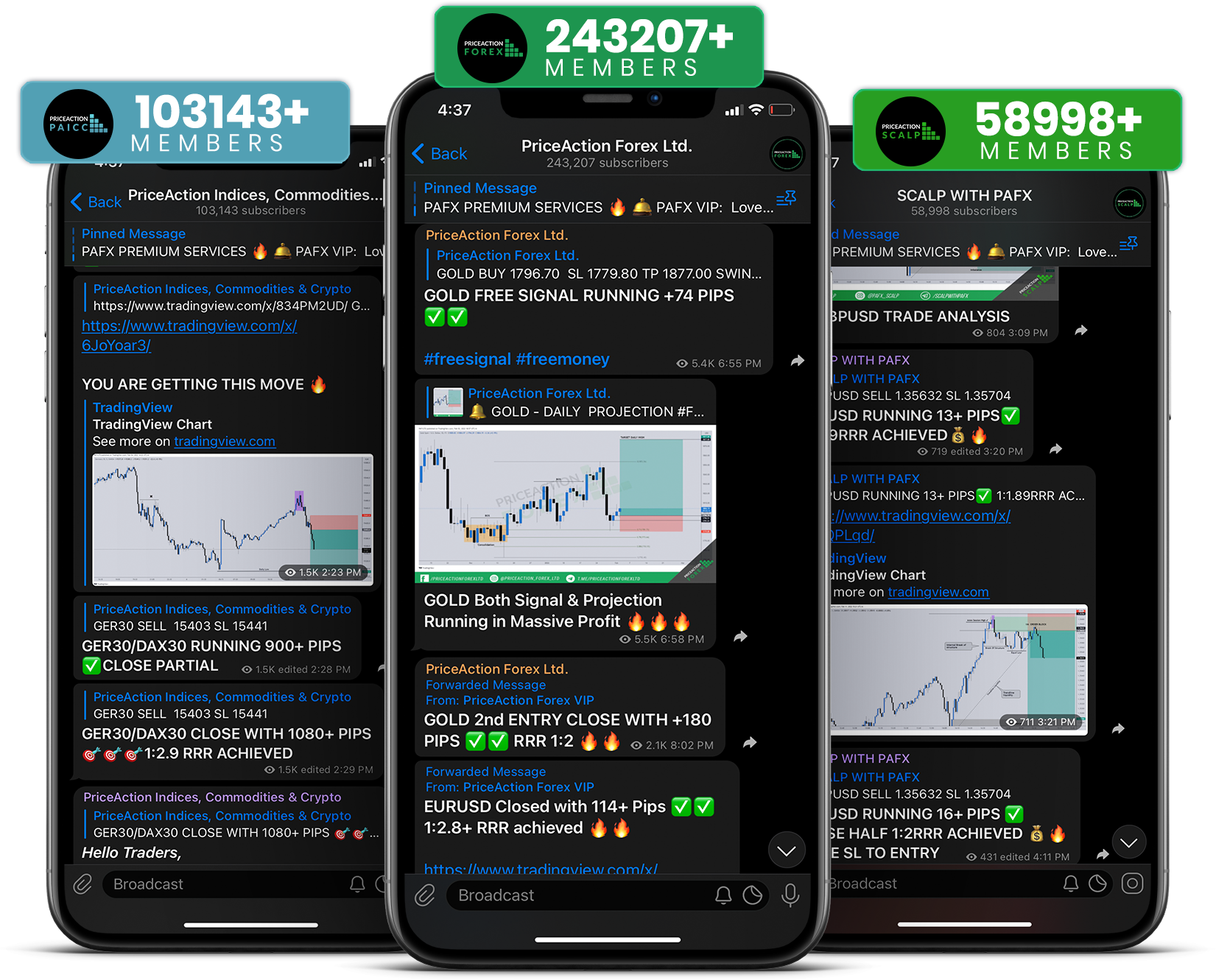

- Get free Forex, Indices, Commodities, Stocks, Scalping signals.

- Leverage the 12+ years of trading experience of our traders.

- Learn our proven and powerful trading strategies.

- Enhance your trading knowledge with free trading analysis.

- Chat 24/7 with our team for any trade assistance.

Never miss a Trading Opportunity

Keeping your wins big and losses small is the only way you stay in the game. Priceaction team is dedicated to ensuring consistent profitability for its clients. As seasoned traders, we simplify the trading process for our clients to avoid confusion and losses.

We are here to help you Fulfill and Reach All of your Trading Goals

We Save Your Time

You don’t need to spend hours in front of the charts and the news channels every day. We do that for you while you can spend that time elsewhere. You can enjoy our service and make money while you are on a job or spending time with your family.

We Save Your Money

Making money consistently in the Forex market takes years of experience which includes losing a lot of money in the process. We trade our expertise to save you from the losses and help you make money from the beginning of your trading journey.

We Do The Hard Work

Our team of professional traders scan the markets 24/7. We analyze and decrypt the markets and economies for you. All of us take the same trades. All of us make money!

We Are Consistent

Consistency is the name of the game. We are a team of disciplined and patient traders and we know what we’re doing. As a result, we’ve always been able to come out profitable, unlike other similar services.

24/7 Support

You can contact us at any time of the day. Our support agents will get back to you in the shortest period of time. You can message us any time of the day with any of your queries and our support agents will always be there to help.

Unbeatable Accuracy

We hold an accuracy of more than 90% which allows us to have very little drawdown and maximum profits.

We have been using them profitably for years

PAFX Pro Signals Indicator

Even If you can't read the charts, you can too grab the market opportunities with our simple but powerful Pro Signal Indicator Get instant access to a simple and proven indicator that has transformed HUNDREDS of beginner traders into a "Expert Day TRADER"

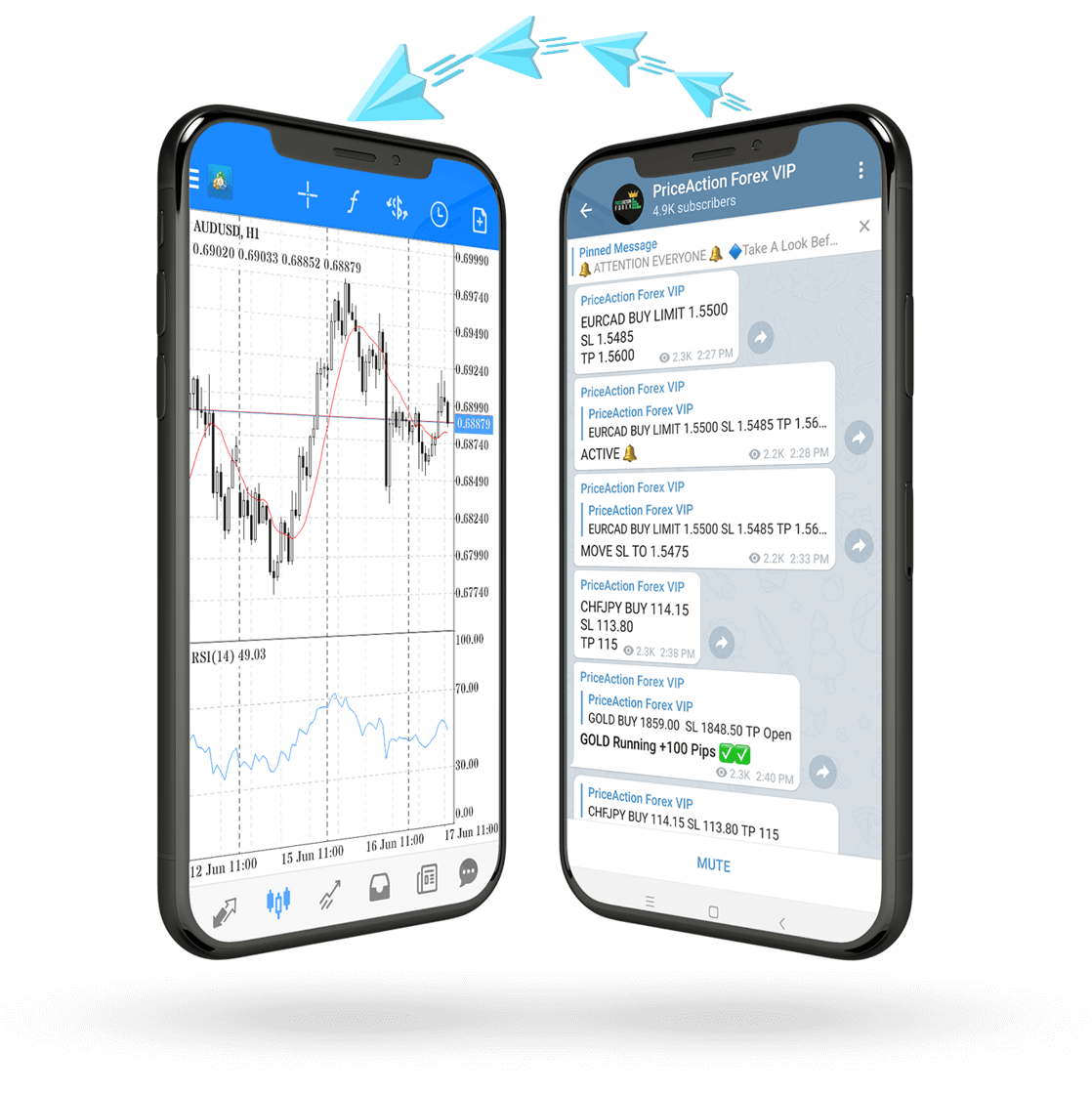

PAFX SIGNAL COPIER

Do Not Miss or Delay Entry/exit of Any Trade From Telegram Again!

Our signal copier will copy all the signals from our telegram signal channels in less than 5 seconds.

THE COMPLETE GUIDE TO FOREX TRADING

Master the Market With Confidence, Discipline, and a Winning Attitude.

We make profit by analyzing the market, now you can too! Learn to do your own trading analysis in a short period of time.

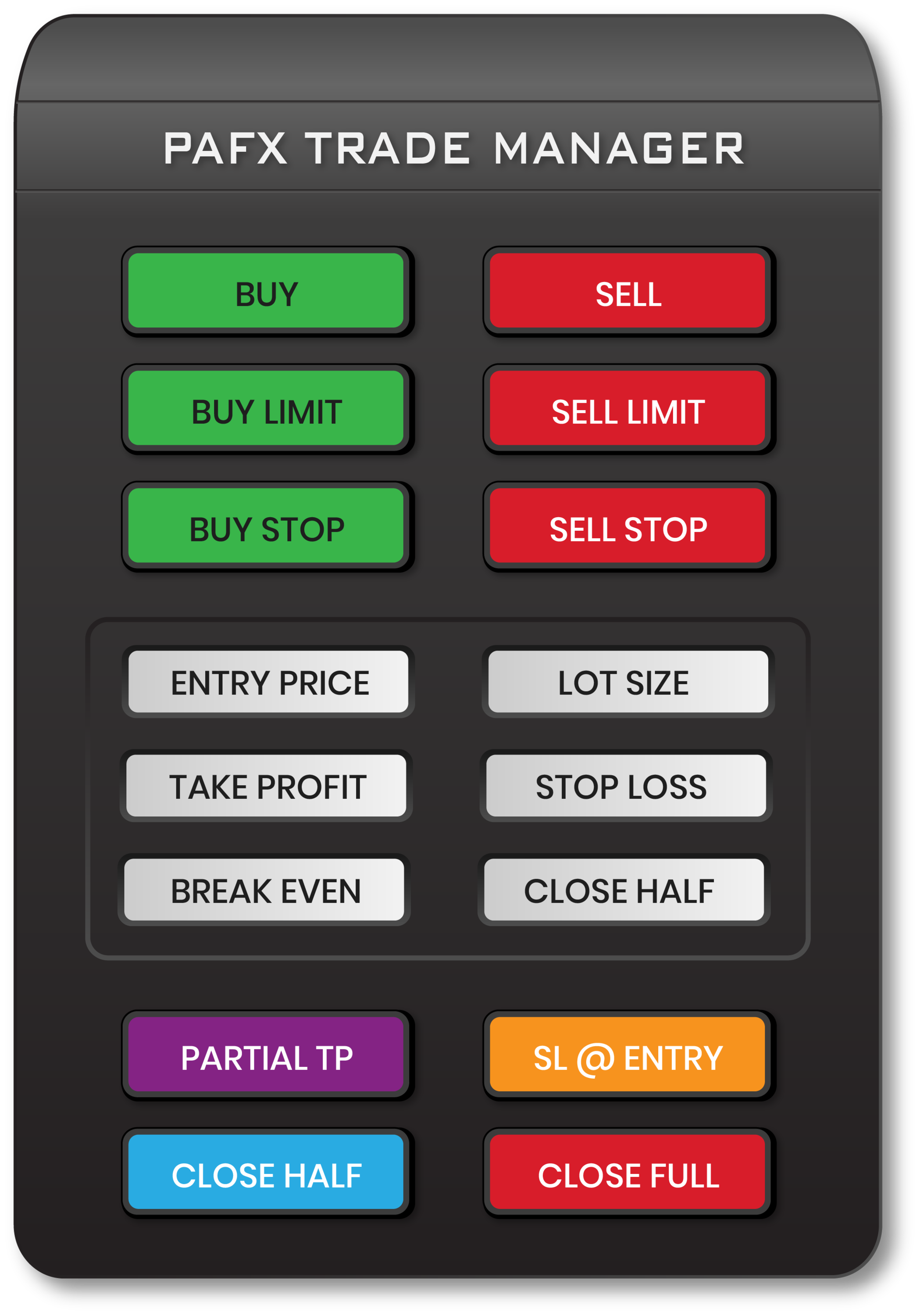

PAFX Trade Manager

PAFX Trade Manager is the most advanced MT4 Trade Manager with 1-Click

PAFX Trade Manager is the most advanced MT4 Trade Manager with 1-Click Execution, Risk Management, Auto Trade Execution, and many other powerful features to make your trading much more efficient.