Supply and demand are the very determinants of price – any price. This applies to everything from your local farmers market, to a rare, one of a kind jewel, to the foreign exchange market. Traders that understand the dynamics of demand and supply are better equipped to understand current and future price movements in the forex market.

What are Supply and Demand Zones

So, what exactly is a supply zone and a demand zone?

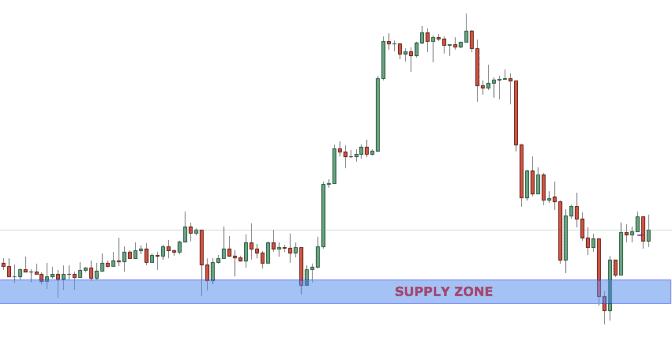

This would be best described by a chart:

In the image above you see the German stock market DAX. The red zone is marked as a supply zone. This could also be defined as an active resistance level or a place where traders are selling huge amounts.

These levels are broader than a resistance line. They are very similar to resistance zones.

On the other side, a Demand zone is a broad area of support, just like the image below.

In the chart above you can see a supply zone or in other words an extensive support level. It is also a level concentrated in buyers. As you can see every time price approaches the supply zone it quickly jumps back up.

Another characteristic of supply and demand zones is the quick price action. As pointed out above, price action is very fast around those levels, so if there are opportunities they are quickly absorbed.